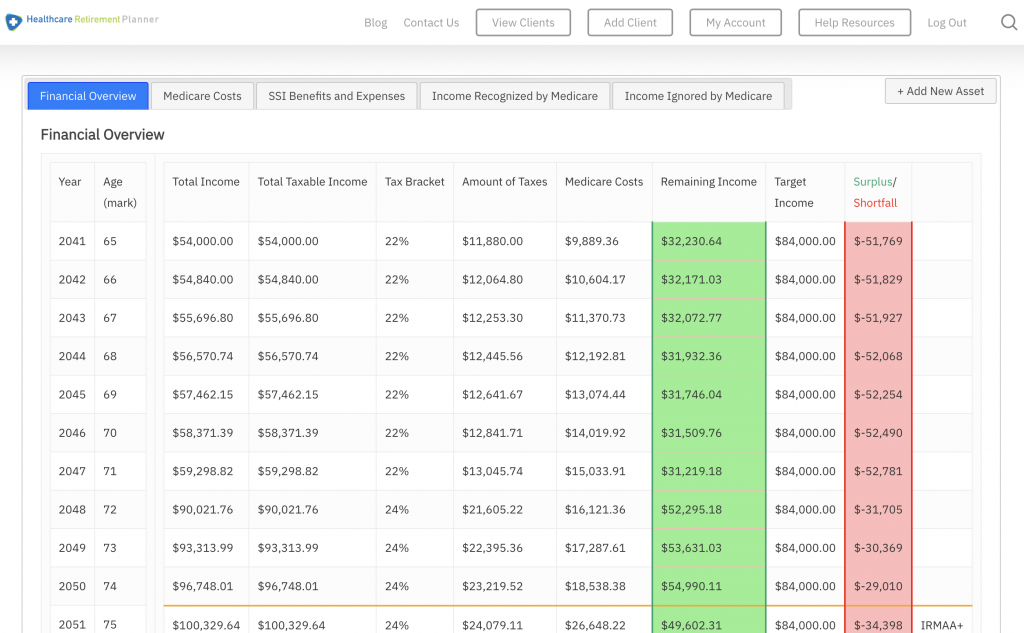

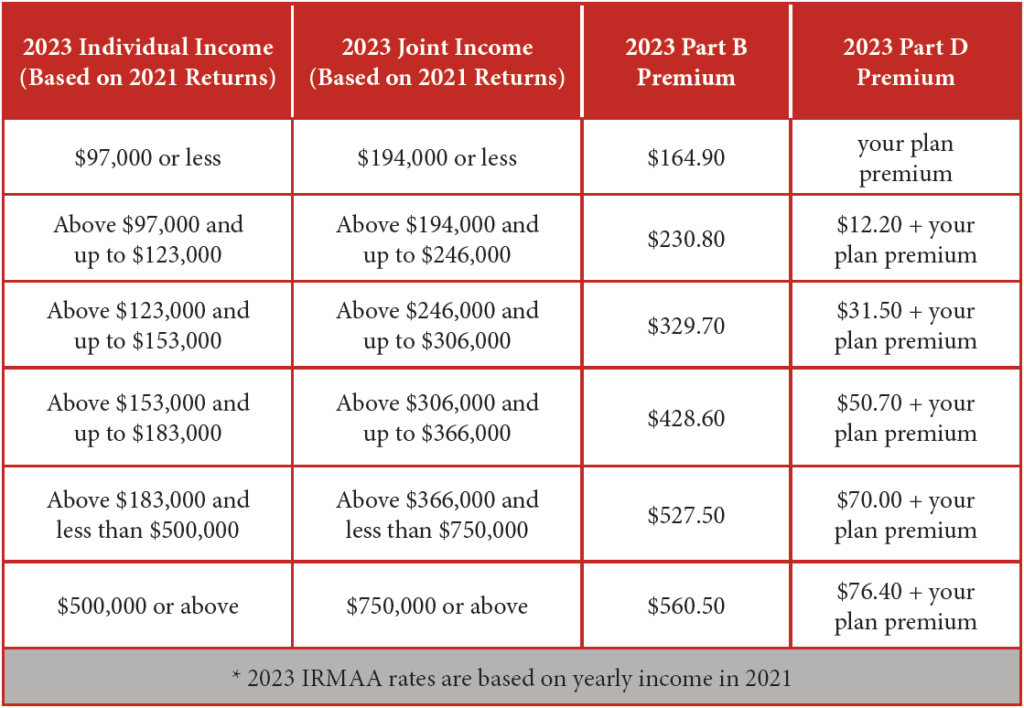

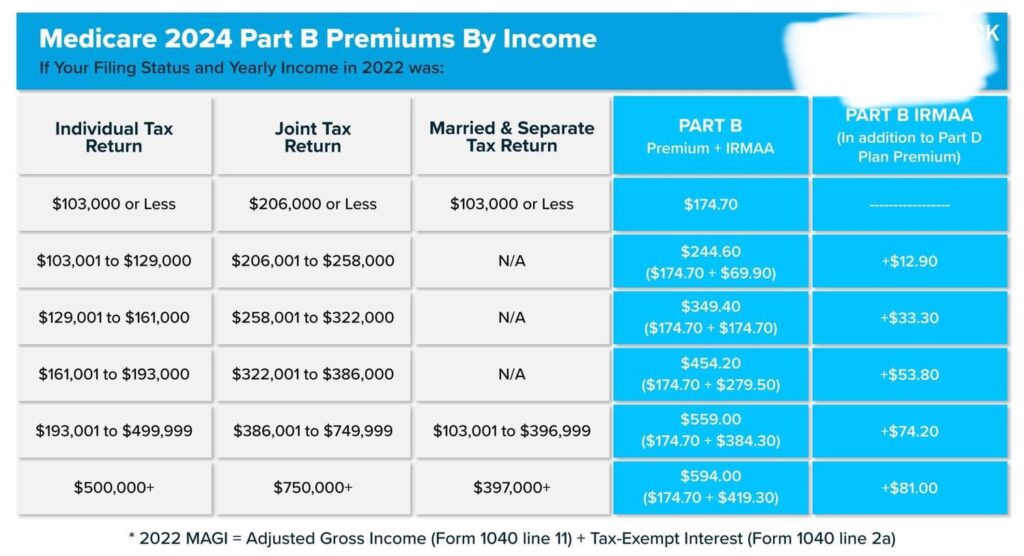

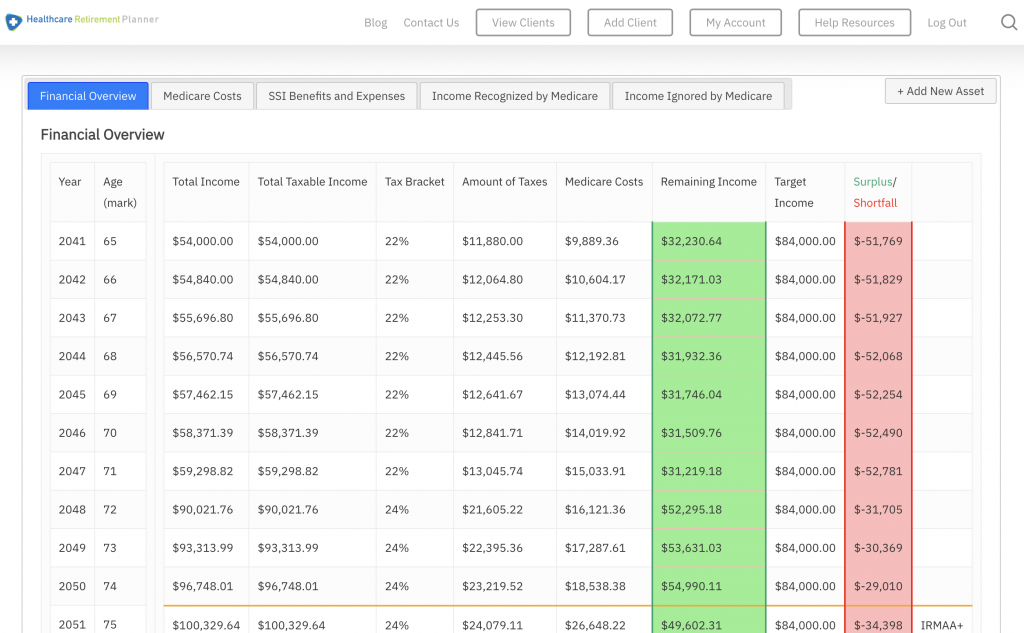

As the new year approaches, Medicare beneficiaries are preparing for potential changes to their coverage and costs. One crucial aspect to consider is the Income-Related Monthly Adjustment Amount (IRMAA), which affects Medicare Part B and Part D premiums. In this article, we will delve into the 2025 IRMAA brackets and rules, providing you with a comprehensive understanding of how these changes may impact your Medicare Advantage costs.

What is IRMAA?

IRMAA is a surcharge applied to Medicare Part B and Part D premiums for beneficiaries with higher incomes. The amount is deducted from your Social Security benefits, and the remaining balance is paid by you. The IRMAA brackets are adjusted annually to reflect changes in the cost of living and Medicare costs.

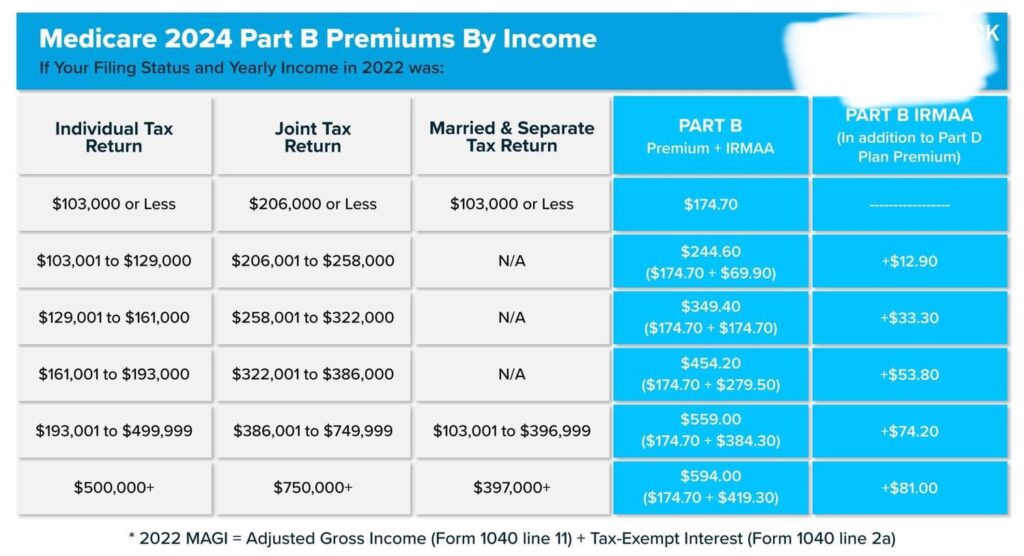

2025 IRMAA Brackets

The 2025 IRMAA brackets are as follows:

Single filers with incomes between $97,000 and $123,000 will pay an additional $65.90 per month for Part B and $12.20 per month for Part D.

Single filers with incomes between $123,001 and $153,000 will pay an additional $159.40 per month for Part B and $31.50 per month for Part D.

Single filers with incomes between $153,001 and $183,000 will pay an additional $252.80 per month for Part B and $50.70 per month for Part D.

Single filers with incomes above $183,000 will pay an additional $346.20 per month for Part B and $69.90 per month for Part D.

Joint filers with incomes between $194,000 and $243,000 will pay an additional $65.90 per month for Part B and $12.20 per month for Part D.

Joint filers with incomes between $243,001 and $303,000 will pay an additional $159.40 per month for Part B and $31.50 per month for Part D.

Joint filers with incomes between $303,001 and $363,000 will pay an additional $252.80 per month for Part B and $50.70 per month for Part D.

Joint filers with incomes above $363,000 will pay an additional $346.20 per month for Part B and $69.90 per month for Part D.

Rules and Exceptions

It's essential to understand the rules and exceptions surrounding IRMAA to ensure you're prepared for any changes to your Medicare Advantage costs. Some key points to consider:

IRMAA is based on your tax filing status and income from two years prior (2023 income for 2025 IRMAA).

If your income has decreased due to certain life events, such as retirement or divorce, you may be eligible to appeal your IRMAA determination.

Beneficiaries with lower incomes may be eligible for Medicare Savings Programs, which can help reduce their Medicare costs.

The 2025 IRMAA brackets and rules can have a significant impact on your Medicare Advantage costs. By understanding these changes and how they apply to your situation, you can better plan for your healthcare expenses. If you're concerned about the potential effects of IRMAA on your Medicare coverage, consider consulting with a licensed insurance agent or broker who can help you navigate the complexities of Medicare and find the most suitable plan for your needs and budget. Visit

MedicareAdvantage.com to learn more about Medicare Advantage plans and to get a quote.

Note: This article is for informational purposes only and is not intended to provide personalized advice. Medicare beneficiaries should consult with a licensed insurance professional or the Social Security Administration for specific guidance on IRMAA and Medicare Advantage costs.