As we step into the new year, it's essential to stay informed about the latest adjustments affecting retirement plans and Individual Retirement Accounts (IRAs). The Internal Revenue Service (IRS) periodically reviews and updates the contribution limits, income thresholds, and other key figures related to these plans to reflect cost-of-living adjustments. For 2025, several adjustments have been made to help individuals better plan for their retirement. In this article, we'll delve into the

PDF 2025 amounts relating to retirement plans and IRAs, as adjusted for inflation and other economic factors.

Introduction to Retirement Plans and IRAs

Retirement plans, such as 401(k), 403(b), and Thrift Savings Plans, along with IRAs, are crucial tools for individuals seeking to secure their financial future. These plans offer tax benefits that can help contributions grow over time, providing a nest egg for retirement. However, the rules governing these plans, including contribution limits and eligibility for deductions, can be complex and are subject to annual changes.

2025 Adjustments for Retirement Plans

The IRS has released the 2025 updates, which include significant changes to contribution limits and income thresholds for deductibility. Key adjustments for retirement plans include:

-

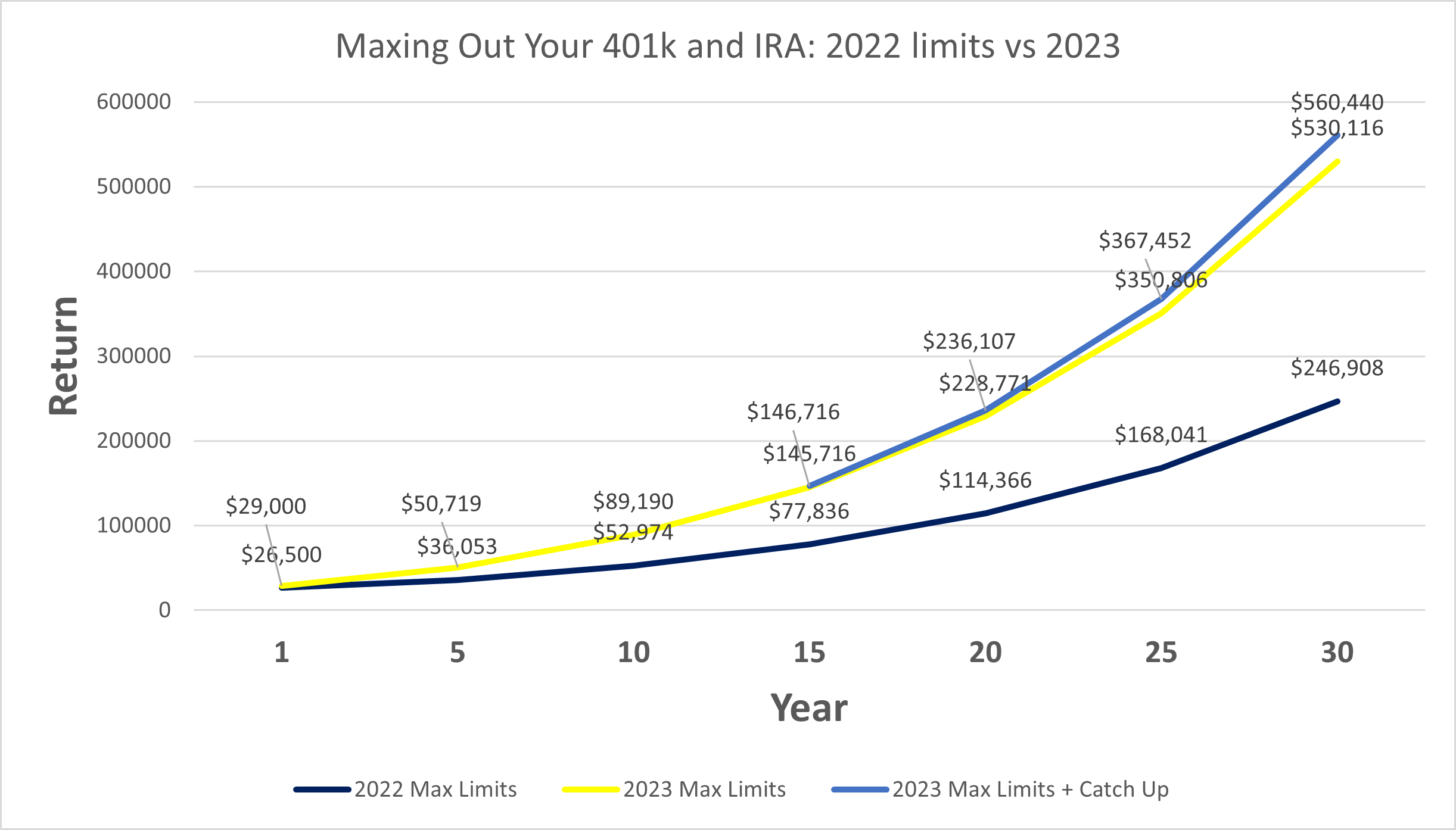

Increased Contribution Limits: The annual contribution limit for 401(k), 403(b), and most 457 plans has been increased, allowing individuals to save more for retirement.

-

Higher Income Limits for Deductions: The income ranges for determining eligibility to deduct contributions to traditional IRAs and to contribute to Roth IRAs have been adjusted upward, making these plans more accessible to a broader range of incomes.

2025 Adjustments for IRAs

For IRAs, the updates focus on making these accounts more beneficial for retirement savings:

-

Roth IRA Income Limits: The income limits for contributing to a Roth IRA have been increased, allowing more individuals to take advantage of this type of IRA.

-

Traditional IRA Deduction Limits: The phase-out ranges for deducting contributions to a traditional IRA have also been adjusted, reflecting the cost-of-living increases.

Importance of Understanding These Adjustments

Staying abreast of these updates is vital for maximizing retirement savings. By understanding the new contribution limits, income thresholds, and other adjustments, individuals can better plan their retirement strategy, potentially increasing their savings and ensuring a more secure financial future.

The

PDF 2025 amounts relating to retirement plans and IRAs, as adjusted for inflation and other factors, offer a roadmap for individuals looking to optimize their retirement savings. Whether you're just starting to plan for retirement or are nearing your retirement age, these updates can have a significant impact on your financial strategy. It's always a good idea to consult with a financial advisor to understand how these changes apply to your specific situation and to make informed decisions about your retirement planning.

By embracing these updates and leveraging the benefits of retirement plans and IRAs, you can work towards securing a comfortable and fulfilling retirement. Remember, planning for retirement is a long-term process, and staying informed about the latest developments is key to achieving your goals.