Table of Contents

- Super Wednesday…The Fun Never Stops

- What Is A Dead Cat Bounce Pattern In Forex? | Phantom Trading

- What is a Dead Cat Bounce? Definition, Explanation, and Trading Guide

- Dead Cat Bounce - Overview, How It Works, Examples | Wall Street Oasis

- What Is a Dead Cat Bounce? Meaning and Definition - Value of Stocks

- What Is a Dead Cat Bounce Pattern, and How Can One Trade It? | Market Pulse

- "Dead Cat Bounce | Funny Cate Meme | Funny Cat T-shirt | Funny Cat Mugs ...

- Dead Cat Bounce: How long does it last? - Phemex Academy

- What is a Dead Cat Bounce & How Do You Trade It? | CMC Markets

- Dead Cat Bounce Strategy for Forex Traders - InvestGrail

Origins of the Term

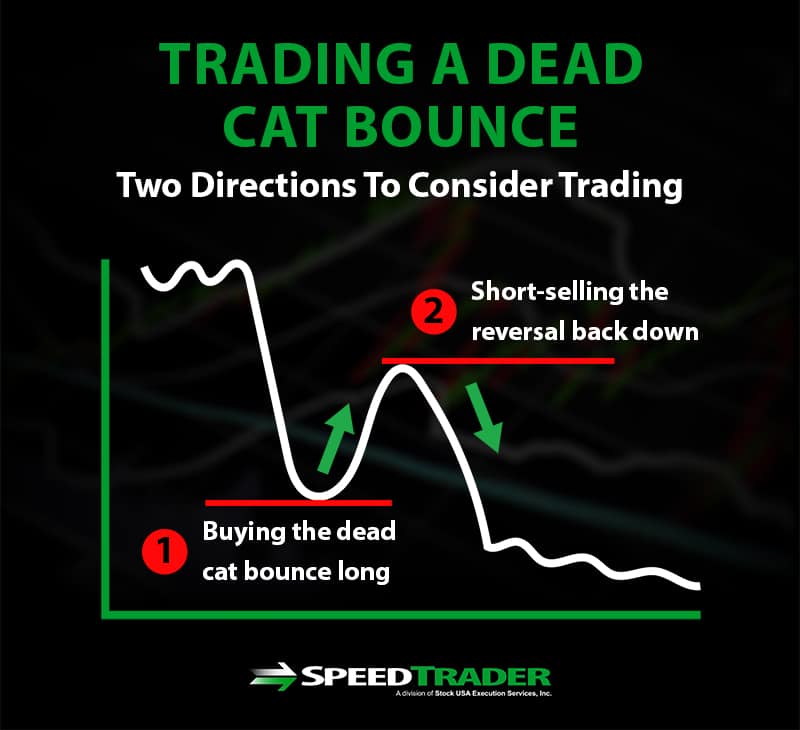

Characteristics of a Dead Cat Bounce

Key Indicators of a Dead Cat Bounce

Identifying a Dead Cat Bounce can be challenging, but there are several key indicators that investors can look out for: - Sudden and Sharp Price Increase: A rapid price increase after a significant decline, without any substantial news or improvement in fundamentals. - Lack of Volume: The price increase is not accompanied by a significant increase in trading volume, indicating a lack of conviction among investors. - Narrow Leadership: The rally is led by a small group of stocks, rather than being broad-based. - Technical Resistance: The price increase is halted at a level of technical resistance, such as a moving average or a previous support level.

Implications for Investors

Understanding the Dead Cat Bounce phenomenon is crucial for investors, as it can help them make informed decisions. Here are a few implications: - Avoid False Hope: Investors should be cautious not to interpret a Dead Cat Bounce as a sign of recovery, as it can lead to false hope and poor investment decisions. - Confirm Trends: It's essential to wait for confirmation of a trend reversal before investing. This can include looking for improvements in fundamentals, increases in trading volume, and breaks above technical resistance levels. - Short Selling Opportunities: For more experienced investors, a Dead Cat Bounce can present opportunities for short selling, as the price is likely to fall back down after the bounce. The Dead Cat Bounce is a fascinating market phenomenon that holds important lessons for investors. By understanding what it is and how to identify it, investors can avoid common pitfalls and make more informed investment decisions. Whether you're a seasoned investor or just starting out, recognizing the signs of a Dead Cat Bounce can help you navigate the complexities of the market with greater confidence. Remember, in the world of finance, knowledge is power, and staying informed is key to success.For more insights and to stay updated on market trends, visit Seeking Alpha, your premier source for stock market news and analysis.