The world of investing can be complex and overwhelming, with numerous options and strategies to consider. For those looking to capitalize on the growth of the technology sector, the ProShares UltraPro QQQ (TQQQ) stock has emerged as a popular choice. In this article, we will delve into the TQQQ stock chart, providing an in-depth analysis of its performance, trends, and potential opportunities for investors.

Introduction to TQQQ

The ProShares UltraPro QQQ is an exchange-traded fund (ETF) that aims to provide 3x daily leveraged exposure to the Nasdaq-100 Index, which is comprised of the 100 largest and most actively traded non-financial stocks listed on the Nasdaq stock market. The fund is designed for sophisticated investors who seek to magnify their returns, but it's essential to note that it also comes with higher risks.

TQQQ Stock Chart Analysis

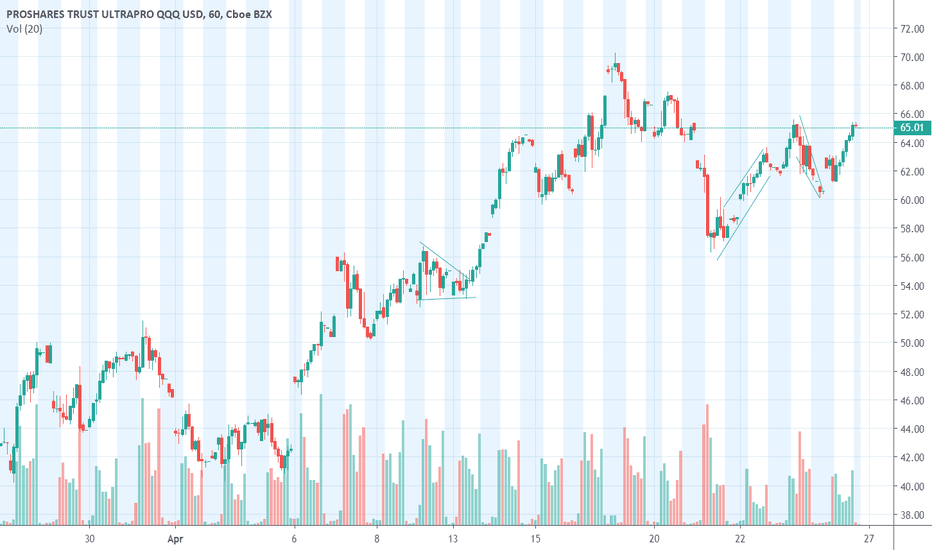

To understand the TQQQ stock chart, it's crucial to examine its historical performance. Over the past year, the stock has exhibited significant volatility, with periods of substantial growth followed by sharp declines. This volatility can be attributed to the fund's leveraged nature, which amplifies both gains and losses.

Using technical analysis, we can identify several key trends and patterns in the TQQQ stock chart:

Trend Lines: The stock has been trading within a well-defined upward trend line, indicating a bullish outlook. However, the trend line has been tested multiple times, and a break below it could signal a reversal.

Support and Resistance: The stock has established a strong support level at $50, which has been tested and held on multiple occasions. Conversely, the $70 level has acted as a resistance, and a break above it could lead to further upside.

Moving Averages: The 50-day moving average has been providing support, while the 200-day moving average has been acting as a resistance. A golden cross, where the 50-day moving average crosses above the 200-day moving average, could be a bullish signal.

Key Metrics and Statistics

To further evaluate the TQQQ stock, let's examine some key metrics and statistics:

Volume: The average daily trading volume is approximately 10 million shares, indicating a highly liquid market.

Market Capitalization: The fund has a market capitalization of over $10 billion, making it a significant player in the ETF space.

Dividend Yield: The TQQQ stock does not pay a dividend, as it is designed for growth rather than income.

The TQQQ stock chart presents a complex and dynamic picture, with both opportunities and risks. While the fund's leveraged nature can amplify returns, it also increases the potential for losses. As with any investment, it's essential to conduct thorough research, set clear goals, and develop a well-thought-out strategy before investing in the ProShares UltraPro QQQ.

By understanding the trends, patterns, and metrics outlined in this analysis, investors can make informed decisions and potentially unlock the growth potential of the TQQQ stock. However, it's crucial to remember that past performance is not a guarantee of future results, and investors should always prioritize risk management and diversification in their investment portfolios.

With the right approach and a deep understanding of the TQQQ stock chart, investors can navigate the complexities of the market and potentially achieve their investment objectives. Whether you're a seasoned investor or just starting to explore the world of ETFs, the ProShares UltraPro QQQ is certainly worth considering.